Bitcoin and Stocks Soar as Trump Announces 90-Day Tariff Pause Excluding China

Bitcoin and stock markets are experiencing a significant upswing following a major trade policy update from President Donald Trump. On Wednesday, the president revealed plans to suspend most trade tariffs for 90 days, a decision that has sparked immediate gains across financial sectors. While the pause applies to many countries, Trump made it clear that China will not benefit from this temporary relief.

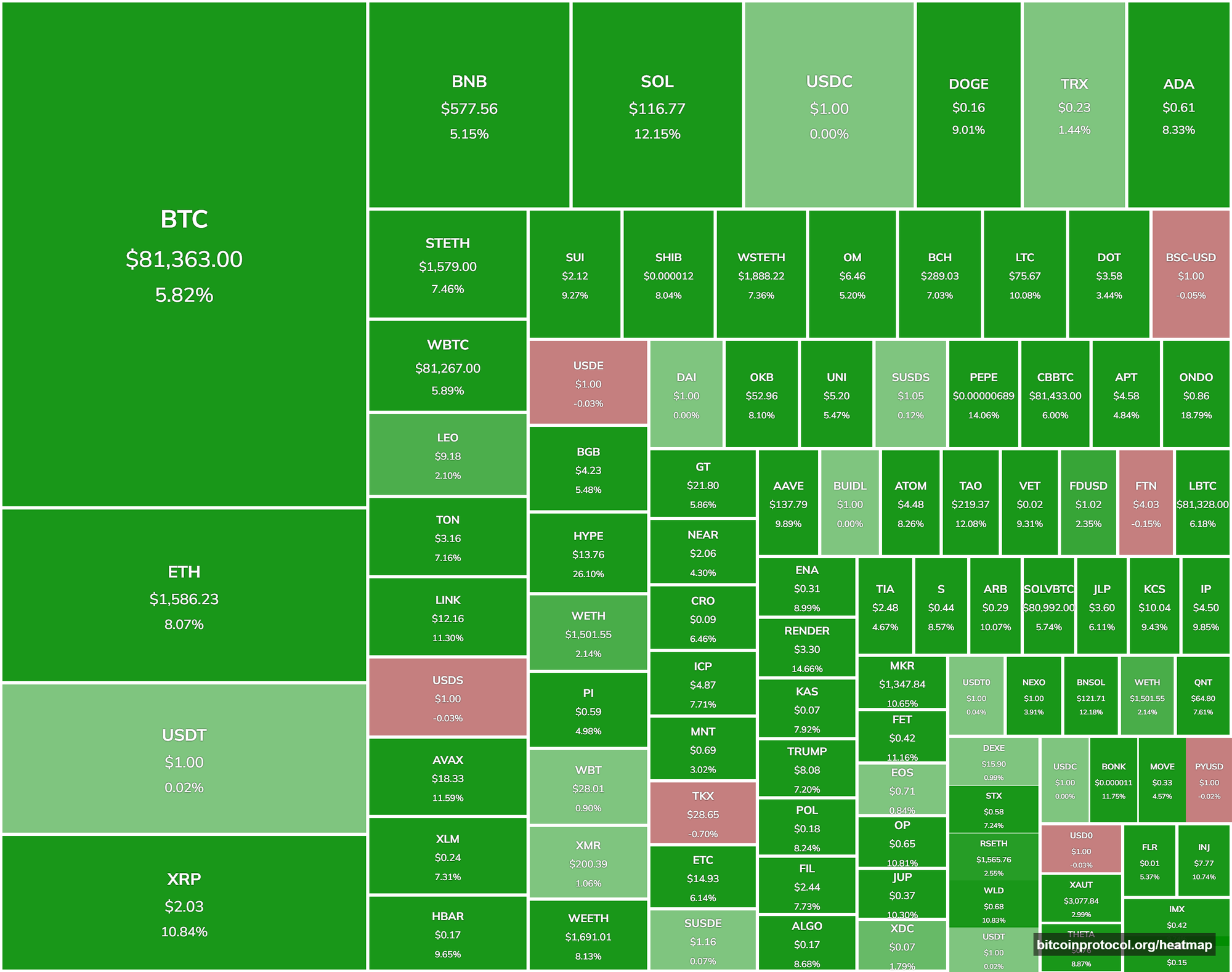

The announcement has sent crypto prices climbing rapidly throughout the day. Bitcoin, the leading digital currency, jumped over 5% within an hour, pushing its value past $81,000. Ethereum followed suit with a nearly 7% increase, reaching $1,580, while Solana saw an even steeper rise of 12%. Investors appear to be reacting swiftly to the prospect of reduced trade barriers, fueling optimism in the crypto space.

Trump said on Truth Social:

Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately. At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable. Conversely, and based on the fact that more than 75 Countries have called Representatives of the United States, including the Departments of Commerce, Treasury, and the USTR, to negotiate a solution to the subjects being discussed relative to Trade, Trade Barriers, Tariffs, Currency Manipulation, and Non Monetary Tariffs, and that these Countries have not, at my strong suggestion, retaliated in any way, shape, or form against the United States, I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately. Thank you for your attention to this matter!

Stock markets are also riding the wave of this news, with major indices posting impressive gains. The S&P 500, Dow Jones Industrial Average, and Nasdaq have all climbed more than 5% in daily trading as of this report. The broad-based rally suggests that businesses and investors see the tariff pause as a positive step for economic growth, at least in the short term.

Trump’s Tariff Strategy Shakes Up Global Markets

In the statement shared by Trump, he outlined the details of his decision, emphasizing both the pause and a reduced reciprocal tariff rate. “I have authorized a 90-day PAUSE, and a substantially lowered reciprocal tariff during this period, of 10%, also effective immediately,” he wrote. He was quick to add that China remains excluded from this relief, signaling a continued hard stance on trade with the nation.

This move comes as part of Trump’s broader approach to reshaping U.S. trade policy, balancing domestic interests with international relations. By lowering tariffs to 10% during the 90-day window, the administration aims to ease pressures on American businesses reliant on global supply chains. The exclusion of China, however, underscores ongoing tensions and a strategic focus on countering its economic influence.

Crypto markets have responded with enthusiasm, reflecting confidence in the potential for increased trade activity. For cryptocurrency traders, the timing aligns with a period of heightened interest in digital assets as hedges against traditional economic uncertainties. Stocks, meanwhile, are buoyed by the prospect of smoother operations for companies that faced higher costs under previous tariff structures.

The effects of this policy shift are likely to unfold over the coming weeks, as businesses adjust to the new trade environment. Analysts will be watching closely to see how the exclusion of China shapes global supply dynamics, particularly for industries dependent on Asian markets. For now, the financial world is buzzing with activity, and both crypto and stock investors are capitalizing on the momentum.