Bitcoin and Crypto Prices Drop Amidst US Tariffs and Fed Policy

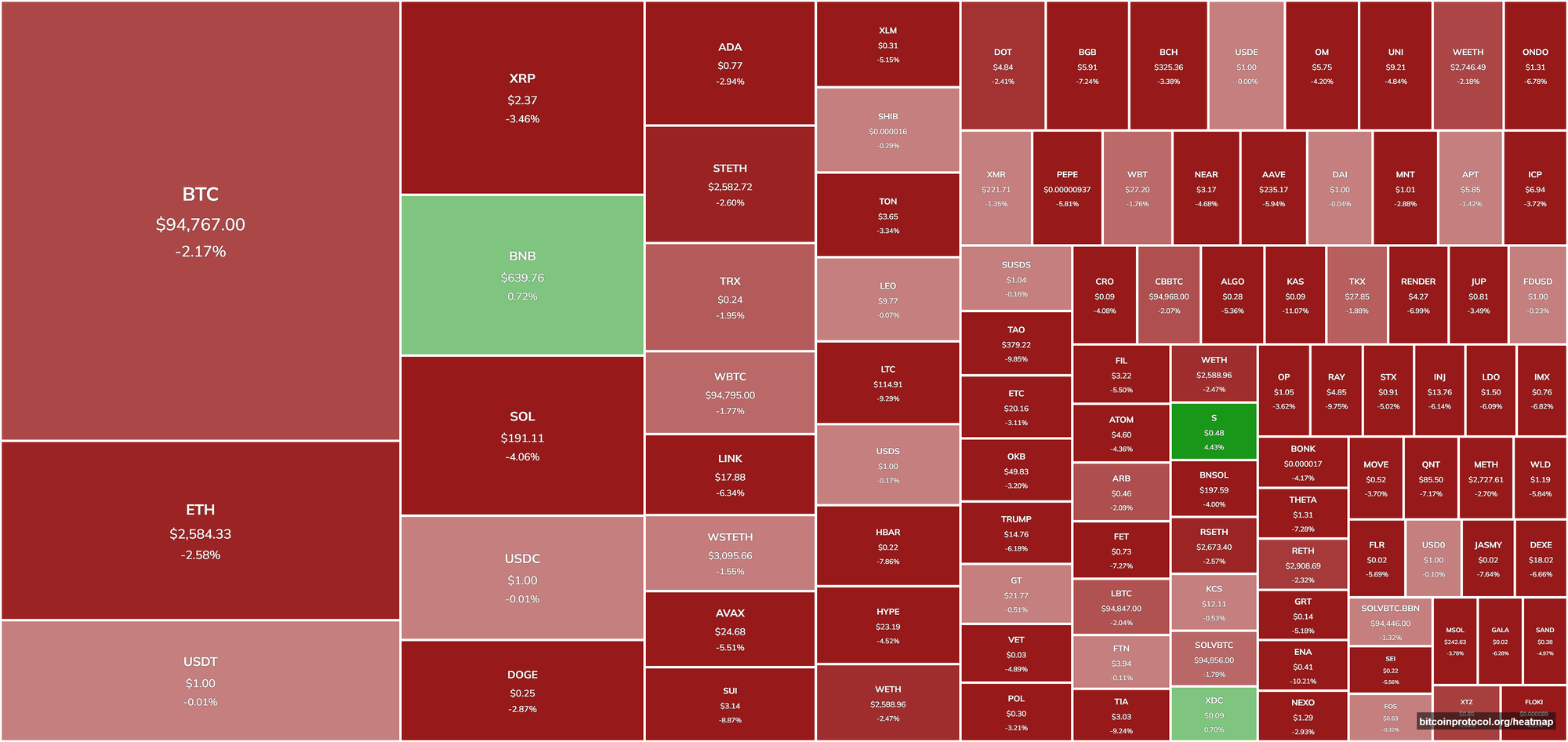

The price of Bitcoin has been on a rollercoaster, with a significant dip to ~$94,000 early this morning before a slight recovery. The global crypto market cap has taken a hit, dropping by 3.5% to $3.28 trillion within the last 24 hours. This volatility isn't happening in a vacuum; it's closely tied to broader economic uncertainties and policies.

The market is caught in a tug-of-war between institutional investors and retail traders. While retail investors are panicking, institutional investors are aggressively buying into Bitcoin and other cryptos, seeing the downturn as a buying opportunity. Some analysts have noted this stark contrast, suggesting that the current retail sentiment might just be the calm before a significant market correction or upturn.

Adding to the market's choppiness are the new tariffs introduced by the Trump administration. A 25% tariff on steel and aluminum imports, alongside additional tariffs on goods from Canada, Mexico, and China, have introduced a wave of uncertainty not just in crypto but across all markets. These protectionist measures could potentially lead to higher inflation, a scenario that markets dread.

Federal Reserve Chair Jerome Powell's recent testimony didn't help calm nerves either. His comments to the U.S. Senate about maintaining a cautious approach to interest rate adjustments for 2025 have left investors guessing. Despite the hawkish undertones, the U.S. Dollar Index (DXY) has shown weakness, which typically would be good news for cryptocurrencies, but the overarching market sentiment is one of caution.

This mix of tariff-induced inflation fears and a Fed that's not rushing into rate cuts paints a complex picture for investors. The anticipation is that these factors could push the Fed towards a more hawkish policy if inflation spikes, leading to even greater volatility in not just bitcoin but also equities and gold. The advice from market observers is clear: brace for significant shifts as these economic policies play out.

In essence, the current scenario in the crypto market, particularly with Bitcoin, is a direct reflection of broader economic policies and uncertainties. Investors, particularly those in the retail space, need to navigate these waters with caution, keeping an eye on both domestic policy changes and global economic signals which could dictate the next big moves in the market.