Bitcoin and Crypto Prices Drop Amid Trump and China Tariff Dispute Escalation

Markets experienced a notable decline on Friday, with Bitcoin falling nearly 2% from $107,000 to $105,000, Ethereum dropping 2% from $2,671 to $2,600, and Solana sliding 5% from $170 to $161. Other major cryptocurrencies followed a similar trend, with declines ranging from 3% to 5%. The downturn aligns with heightened global trade tensions, particularly following U.S. President Donald Trump’s recent statements on Truth Social accusing China of violating a trade agreement. This escalating dispute, centered on tariffs and critical minerals, has rattled investor sentiment and contributed to the broader market pullback.

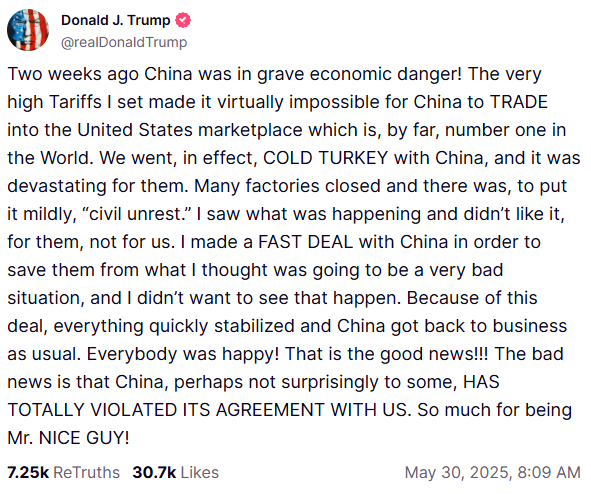

Trump’s Tariff War and China’s Alleged Violations

The primary driver behind today’s crypto market price drop appears to be macroeconomic uncertainty stemming from renewed U.S. and China trade tensions. President Trump announced on Truth Social that China had violated a mid-May agreement to mutually roll back triple-digit tariffs for 90 days, a deal he described as a lifeline to stabilize China’s economy amid factory closures and civil unrest. Trump claimed the tariffs, which reached up to 145% on Chinese imports, had placed significant pressure on China, but he did not specify the exact nature of the violation.

A U.S. official, speaking to Reuters, suggested China was slow to issue export licenses for rare earth minerals, a critical component of the Geneva agreement. U.S. Trade Representative Jamieson Greer echoed this sentiment on CNBC, stating that China’s failure to resume the flow of critical minerals was “completely unacceptable” and required action.

The temporary truce in May had sparked a relief rally in global markets, including cryptocurrencies, as investors anticipated a de-escalation of the trade war. However, the lack of progress in trade talks, as noted by Treasury Secretary Scott Bessent on Fox News, has reintroduced uncertainty. Bessent indicated that negotiations were “a bit stalled” and might require direct intervention from Trump and Chinese President Xi Jinping. The absence of clarity on China’s compliance and the potential for renewed tariffs have prompted a risk-off sentiment, impacting assets like Bitcoin, Ethereum, and Solana, which are increasingly correlated with traditional markets. This correlation was evident as global stock indices, such as the S&P 500 and Nasdaq, also faced pressure, reflecting broader economic jitters.

The cryptocurrency market’s reaction mirrors its sensitivity to macroeconomic events, as seen in previous tariff related sell-offs. For instance, a similar market downturn occurred in April when Trump announced sweeping reciprocal tariffs, causing Bitcoin to drop to $77,000 and Ethereum and Solana to fall over 6%. Today’s decline, while less severe, underscores the market’s vulnerability to trade policy shocks. Investors appear to be de-risking their portfolios, favoring safer assets like cash and gold, as highlighted by analysts noting a shift to “risk-off mode” amid tariff headlines. This cautious approach has amplified selling pressure on cryptocurrencies, which are often viewed as risk assets during periods of uncertainty.

Despite the downturn, some market observers remain optimistic about cryptocurrencies’ long-term prospects. The recent whale accumulation of Bitcoin, with over 2,000 addresses holding between 1,000 to 10,000 BTC, suggests institutional and high-net-worth investors are positioning for future gains. However, near-term resistance levels, such as Bitcoin’s $107,252 support, will be critical to watch. If prices break below this threshold, further declines to $106,080 or $104,145 could follow, as noted by technical analysts. For now, the crypto market remains at the mercy of global trade developments, with Trump’s next moves and China’s response likely to dictate the direction of prices in the coming weeks.