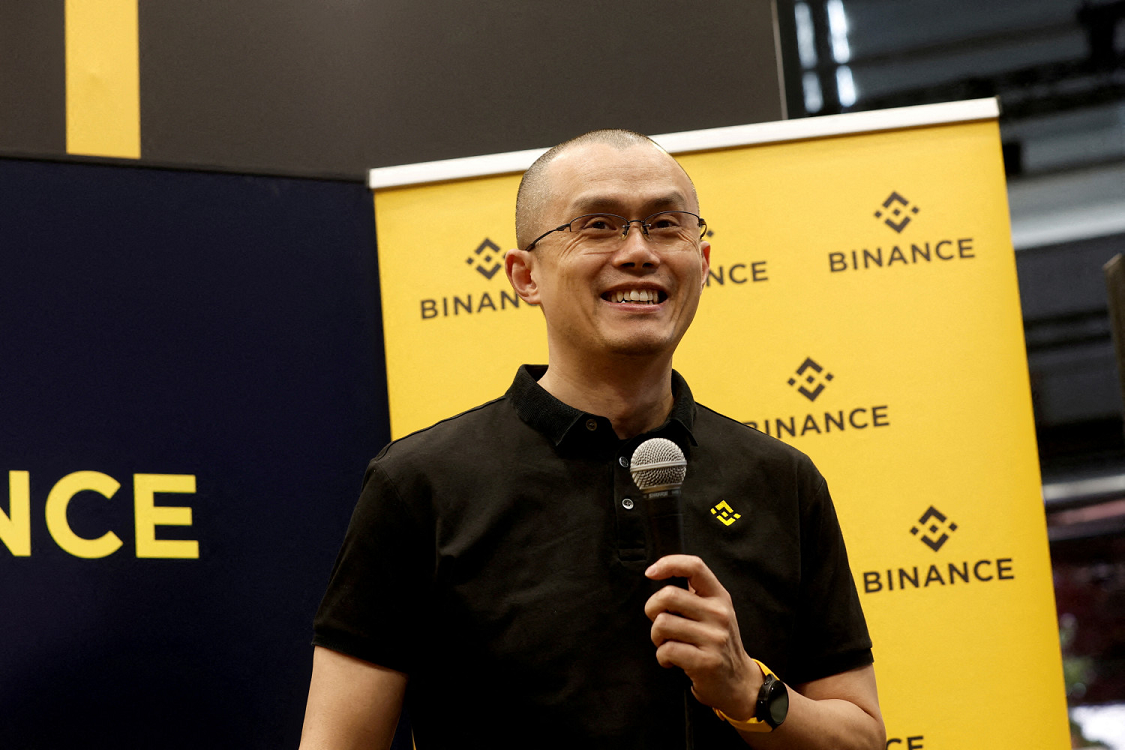

Binance Founder CZ Sparks Return Speculation Amid DOJ Settlement Talks

Changpeng Zhao, widely known as just CZ, has ignited fresh discussions in the crypto community by updating his X profile. The change he made, although it may seem minor, isn't when you think about it; the change removes the "ex-Binance" descriptor (archived July 2025) that he had and now simply says "Binance," prompting speculation about his potential involvement with the exchange once again. This development comes at a time when Binance is engaged in negotiations with U.S. federal prosecutors to modify terms from its landmark 2023 settlement.

The timing of Zhao's profile adjustment aligns closely with reports on Binance's ongoing talks with the Department of Justice. Bloomberg detailed that the exchange is pushing to eliminate a required independent compliance monitor as part of the $4.3 billion agreement addressing anti-money laundering shortcomings. Federal authorities imposed the three-year oversight to ensure Binance strengthens its internal controls, but no final ruling has emerged from the discussions.

Zhao's history with Binance adds layers to the current buzz. He founded the platform in 2017 and grew it into the world's largest cryptocurrency exchange by trading volume. In November 2023, Zhao resigned as CEO following a coordinated settlement involving the DOJ, the Commodity Futures Trading Commission, the Financial Crimes Enforcement Network, and the Treasury's Office of Foreign Assets Control. That deal included his guilty plea to violations of anti-money laundering laws, a $50 million personal fine, and a four-month prison sentence he completed earlier this year.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishMarket Response and BNB's Surge

The crypto market has shown immediate sensitivity to these developments, particularly with Binance's native token, BNB. Just a week ago, BNB touched a record high above $900, and it has continued climbing in recent days. Over the past 24 hours, the token rose more than 3% to reach $951, reflecting trader optimism tied to the potential easing of regulatory burdens on Binance.

This price movement underscores BNB's close linkage to the exchange's fortunes. As the utility token for Binance's ecosystem, it benefits from increased platform activity and positive news. The recent highs follow a period of steady gains, with BNB surpassing previous peaks amid broader crypto market recovery. Traders view the possible removal of the DOJ monitor as a step toward normalized operations for Binance, which could enhance user confidence and trading volumes.

Zhao's influence remains a key factor in these reactions. Even after stepping down, he holds significant equity in Binance and continues to shape industry conversations through his public presence. His profile update, while subtle, serves as a reminder of his enduring role in the company's narrative. Community members and analysts alike are parsing the move for signs of deeper re-engagement, especially as the exchange navigates a shifting regulatory landscape under the current administration.

Binance has made strides in compliance since the settlement, including partnerships with traditional finance players and assistance in global law enforcement efforts. These actions may bolster its case for reduced oversight, potentially replacing the monitor with stricter internal reporting. For BNB holders, the token's momentum suggests sustained interest, with eyes now on whether it can approach $1,000 in the near term.