Arkham Intelligence Maps Strategy’s Bitcoin Holdings Despite Saylor’s Security Concerns

Strategy’s outspoken founder, Michael Saylor, has long resisted calls for onchain wallet transparency, most recently citing significant security risks at the Bitcoin conference 2025 in Las Vegas. However, onchain analytics firm Arkham Intelligence recently took matters into its own hands, revealing it has traced nearly 88% of Strategy’s Bitcoin reserves, valued at over $5.4 billion.

At the Bitcoin conference, Saylor reiterated his concerns about publicizing wallet addresses, speculating that such disclosures can compromise privacy and create vulnerabilities, although security experts and people in the crypto field mostly agree that disclosing wallet addresses isn't a security risk. However, Saylor argues that open wallet data invites attacks from hackers, nation-state actors, and online trolls, particularly for high-profile entities like Strategy. The company, a pioneer in corporate Bitcoin adoption, holds a substantial portion of its treasury in the cryptocurrency, making it a prime target. Saylor’s stance reflects a broader debate about balancing transparency with the need to protect assets in an increasingly scrutinized market.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishArkham’s Forensic Breakthrough and Industry Implications

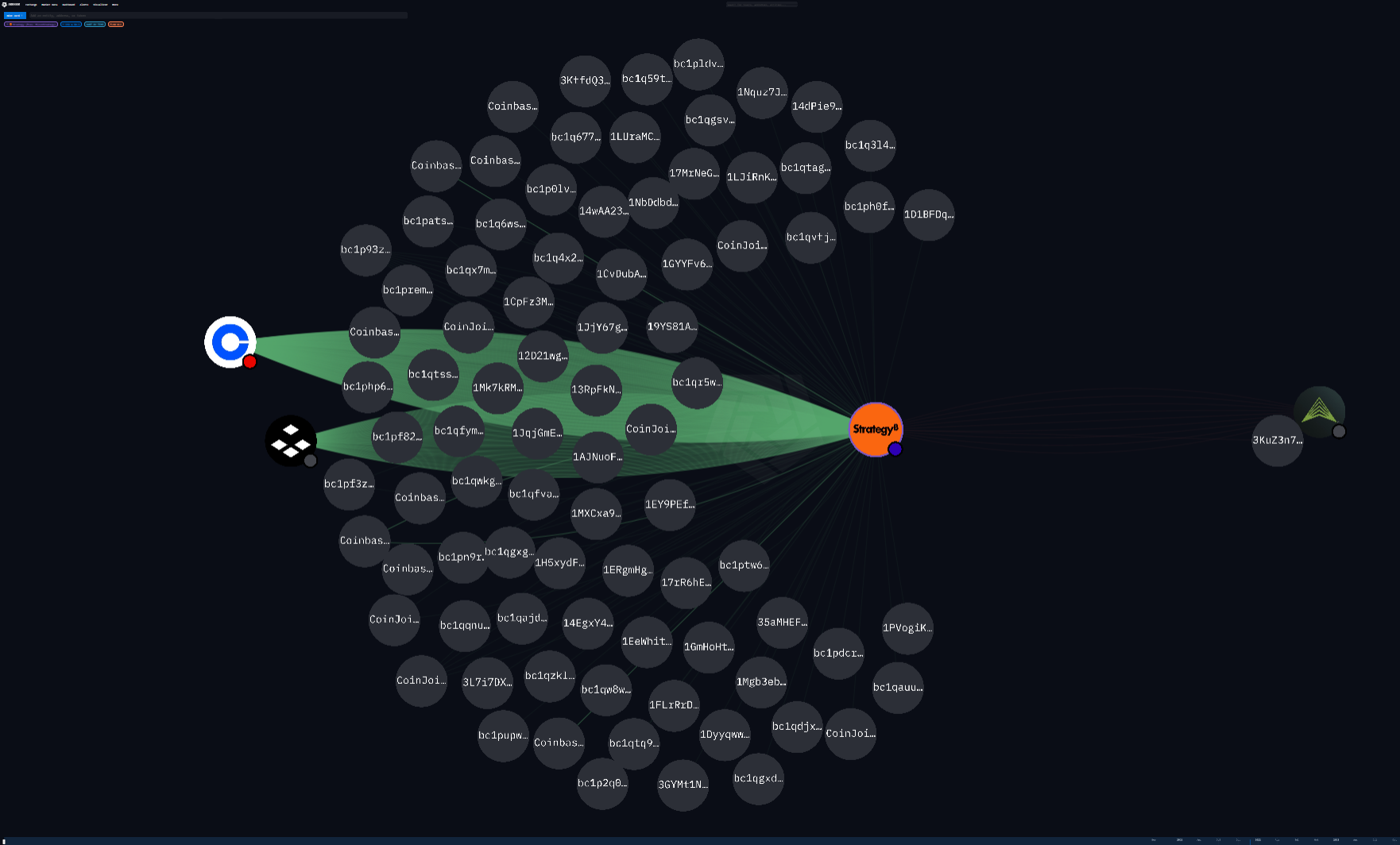

Despite Saylor’s objections, Arkham Intelligence successfully mapped 70,816 BTC—worth approximately $5.45 billion—across wallets linked to Strategy. This figure accounts for about 87.5% of the company’s publicly disclosed Bitcoin holdings, including assets custodied with Fidelity Digital Assets. Arkham’s analysis relied on sophisticated forensic tools, tracing deposit patterns, clustering addresses, and monitoring inflows from major exchanges. The firm’s ability to independently verify such a significant portion of Strategy’s reserves highlights the power of onchain analytics in providing third-party audits without direct cooperation from asset holders.

In a post on X, Arkham said,

"We have identified an additional 70,816 BTC belonging to Strategy, bringing our total identified MSTR BTC holdings to $54.5 Billion. We are the first to publicly identify these holdings.

This represents 87.5% of total MSTR holdings (including assets in Fidelity Digital’s omnibus custody)."

The rise of onchain transparency tools comes in the wake of high-profile failures like the 2022 collapse of FTX, which exposed the risks of opaque financial practices in the crypto industry. In response, exchanges like Binance adopted Merkle tree-based proof-of-reserves to reassure users, though critics argue these snapshots can be manipulated to present a misleading picture of solvency. Arkham’s approach, by contrast, offers a more dynamic view of holdings, using blockchain data to track funds over time. This method has gained traction among investors seeking greater accountability from both corporations and exchanges.

Arkham’s track record extends beyond Strategy, with the firm previously identifying crypto portfolios tied to former U.S. President Donald Trump and El Salvador’s national Bitcoin reserve. These high-profile attributions demonstrate the growing sophistication of blockchain analytics and their role in fostering market trust. For companies like Strategy, however, such disclosures raise concerns about unintended consequences, including targeted attacks or regulatory scrutiny. Saylor’s caution reflects a belief that the risks of transparency may outweigh the benefits, particularly for firms with substantial crypto exposure.

The debate over onchain transparency is unlikely to subside as analytics firms continue to refine their tools. For now, Arkham’s mapping of Strategy’s Bitcoin holdings serves as a proof-of-concept for independent verification in the crypto space. While transparency advocates celebrate this as a step toward greater accountability, others warn that it could set a precedent for invasive scrutiny. As the industry evolves, finding a balance between openness and security will remain a critical challenge for corporate adopters of Bitcoin and other cryptocurrencies.

This development also raises questions about the future of corporate crypto strategies. As firms like Strategy accumulate significant Bitcoin reserves, the pressure to demonstrate solvency and responsibility will only intensify. Arkham’s work shows that, willing or not, companies may find their holdings under the microscope of blockchain analysts. For investors, this offers a new layer of insight into corporate treasuries, but for executives like Saylor, it’s a reminder of the complex trade-offs in the pursuit of financial innovation.