Argentina President Javier Milei's Endorsement Leads to Massive Memecoin Rugpull

In what can only be described as a whirlwind of hype followed by a colossal crash, Argentina's President Javier Milei inadvertently became the face of one of the most dramatic rug pulls in crypto history. The incident centered around a memecoin named Libra on the Solana network, which was touted as a means to bolster the Argentine economy by supporting small businesses and startups.

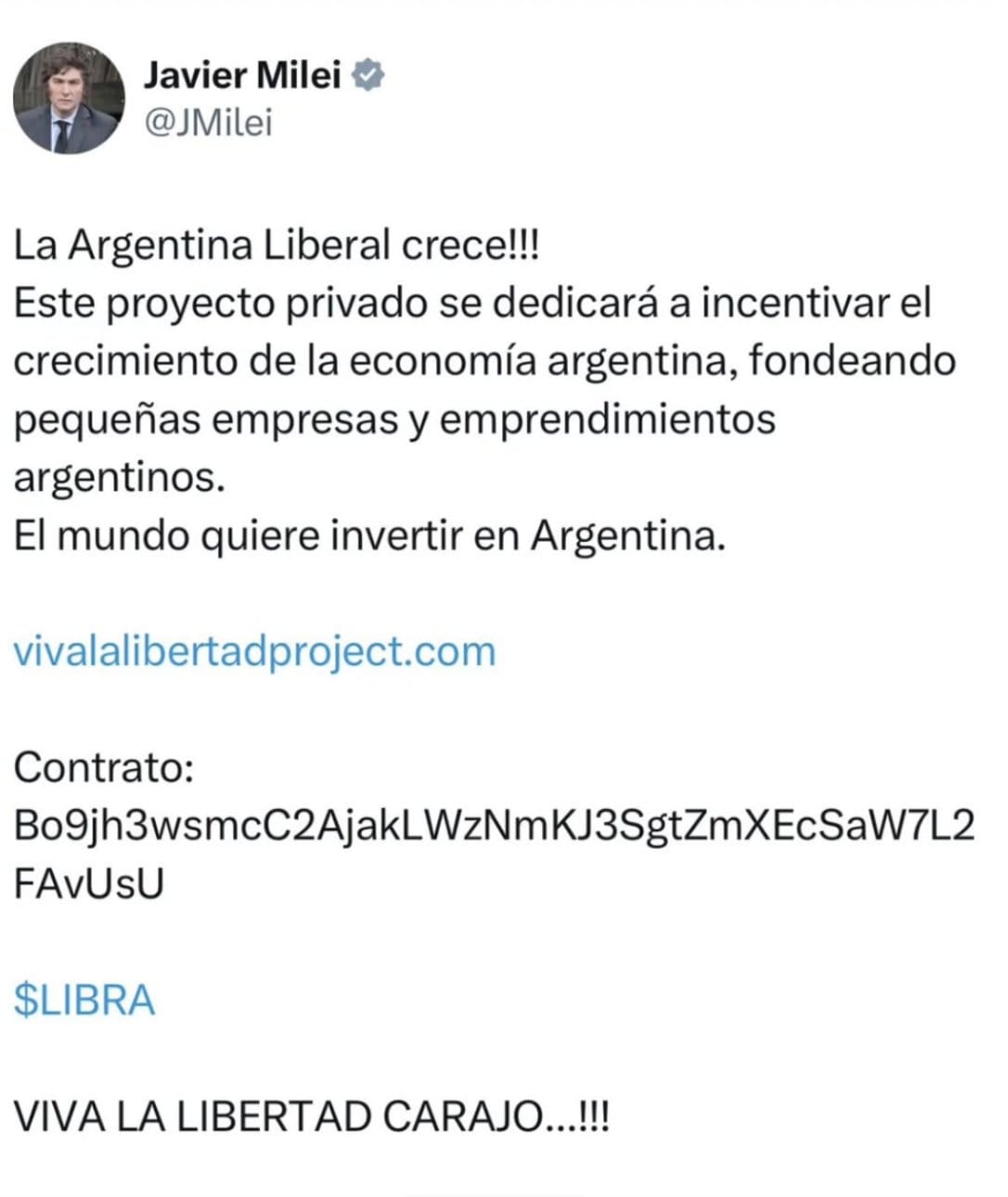

Milei's enthusiasm for the project was palpable when he took to social media to endorse it, describing Libra as a "private project dedicated to encouraging the growth of the Argentine economy."

His tweet acted like rocket fuel for degens, propelling the token's value skyward as traders eagerly invested, hoping to ride the wave of this presidential-backed initiative.

However, the high hopes were quickly dashed. It turned out that the distribution of Libra was heavily skewed, with an astonishing 82% of the tokens in the hands of a few insiders. These individuals, perhaps seeing the peak of the hype, decided to cash out, selling their holdings for an estimated $107 million absolutely destroying the trenches. This sudden sell-off led to a staggering 95% drop in the token's value, leaving late investors with nearly worthless digital assets.

The Aftermath and Milei's Response

Following the catastrophic price drop, President Milei swiftly deleted his promotional tweet. In an attempt to distance himself from the debacle, he later explained that he was "not aware of the details of the project" and upon learning more, chose to stop promoting it.

This statement, however, did little to soothe the burned investors who had followed his lead.

Hace unas horas publiqué un tweet, como tantas otras infinitas veces, apoyando un supuesto emprendimiento privado del que obviamente no tengo vinculación alguna.

— Javier Milei (@JMilei) February 15, 2025

No estaba interiorizado de los pormenores del proyecto y luego de haberme interiorizado decidí no seguir dándole…

This event underscores the risks inherent in the volatile world of memecoins, where endorsements from high-profile individuals can lead to massive, but often short-lived, spikes in value. It also highlights the importance of due diligence, even when the endorsement comes from a figure as significant as a country's president. The Libra incident serves as a warning about the dangers of investing based on hype alone, especially in a market where the potential for manipulation by insiders is high.