Amazon Investors Urge Company to Embrace Bitcoin for Inflation Protection

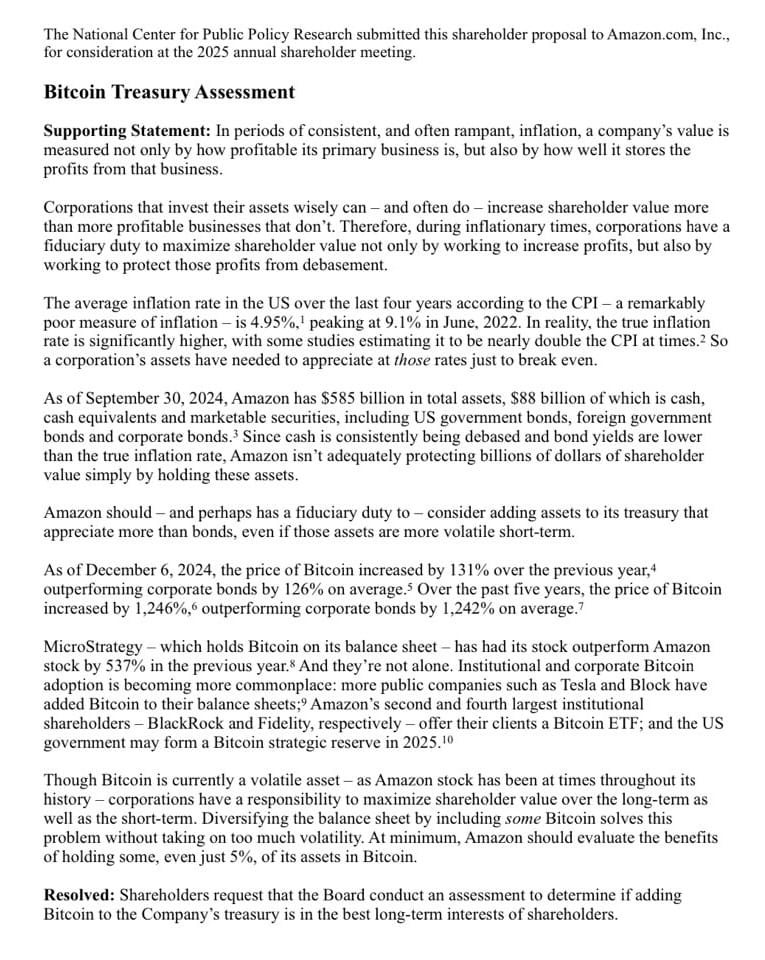

Amazon shareholders are pushing for a significant shift in the company's investment strategy according to a newly discovered filing by the National Center for Policy Research, who are advocating for Amazon to consider adding Bitcoin to its treasury, mirroring the moves of industry giants like Microsoft and Tesla. This suggestion isn't just about jumping on the cryptocurrency bandwagon; it's a strategic move aimed at safeguarding the company's vast financial reserves against the erosive effects of inflation.

The reasoning behind this proposal is straightforward yet compelling. With inflation on the rise, the value of cash and bonds is diminishing, rendering them less effective as stores of value. Bitcoin, however, has demonstrated remarkable growth. In 2024 alone, its value surged by 131%, significantly outpacing traditional bonds. Over the past five years, Bitcoin's value has skyrocketed by over 1,200%, showcasing its potential as a hedge against inflation and a tool for wealth preservation.

The document states, “Shareholders request that the Board conduct an assessment to determine if adding Bitcoin to the Company's treasury is in the best long-term interests of shareholders.”

The Case for Bitcoin in Amazon's Financial Strategy

Amazon, with its hefty $585 billion in assets, including $88 billion in cash and bonds, stands at a pivotal point. The shareholders argue that by allocating even a small portion of these assets—say, 5%—into Bitcoin, Amazon could not only shield its profits from inflation but also potentially tap into the cryptocurrency's growth trajectory for higher returns. This approach has already been adopted by companies like MicroStrategy, whose stock price has benefited from its significant Bitcoin holdings. Tesla and Block (formerly Square) have similarly ventured into Bitcoin, seeing it as both a protective measure and an investment opportunity.

The volatility of Bitcoin is acknowledged, yet the long-term perspective is what's emphasized here. While short-term fluctuations could pose risks, the broader trend of Bitcoin's value appreciation suggests it could offer substantial long-term benefits. This isn't about betting the house on cryptocurrency but about diversifying into assets that can maintain or increase value in an inflationary environment.

This shareholder proposal reflects a broader trend where corporations are reevaluating their asset management strategies in light of economic shifts. As Bitcoin gains acceptance not just as a speculative asset but as a legitimate component of corporate treasuries, more companies might follow suit. Microsoft's upcoming vote on similar measures is a testament to this growing interest.

Amazon's stance on whether to incorporate Bitcoin into its balance sheet remains to be seen. However, the conversation itself marks a significant moment where one of the world's largest companies is considering how digital currencies could fit into its financial strategy. This move could signal to other corporations the potential benefits of crypto in their asset allocation, potentially leading to a new norm in corporate finance where Bitcoin plays a role in protecting and enhancing shareholder value in an unpredictable economic landscape.