99% of Pump.fun Traders on Solana Have Yet to See Profits

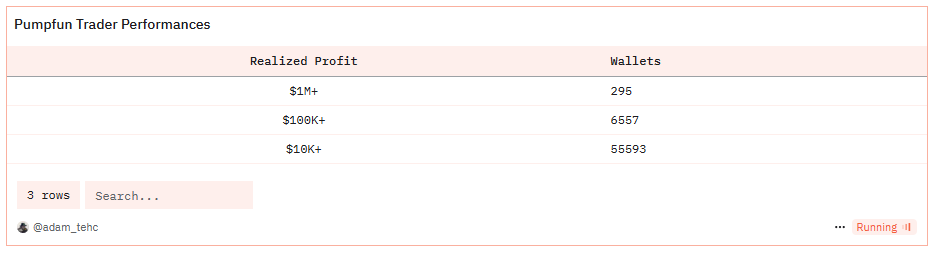

Recent data from Dune analytics has sparked a conversation about profitability on platforms like Pump.fun, where traders engage in creating and trading Solana based memecoins. According to this data, an overwhelming 99.6% of Pump.fun traders have not managed to lock in profits exceeding $10,000. This statistic might paint a grim picture for most participants, suggesting that the dream of significant gains is not easily realized.

Dune analyst Adam Tehc highlighted on X that achieving a $10,000 profit places a trader in the elite 0.412% of wallet addresses on Pump.fun. This data only accounts for realized profits, meaning those gains that have been actualized by selling the cryptocurrency. The broader implication here is that while many might hold assets with potential for profit, only a fraction have converted those potential gains into tangible wealth.

Profit Realization on Pump.fun

However, the narrative isn't as straightforward as the raw data might suggest. Current data does not consider the profits from trades made after tokens have bonded to Raydium, a popular decentralized exchange for these memecoins. Such omissions could significantly skew the actual profitability figures. The real number of profitable wallets might be substantially higher if these additional trades were accounted for. Traders holding onto their assets, potentially waiting for better market conditions or believing in long-term growth, might represent some of the most profitable wallets, even if those gains remain unrealized.

Despite individual trader's challenges, Pump.fun itself has seen robust revenue growth. On January 2, 2025, Lookonchain reported that Pump.fun had amassed nearly $398 million in SOL tokens, indicating a healthy platform revenue despite a general downturn in the market cap during December. This revenue has been partly facilitated by converting significant amounts of SOL to USD Coin, showing a strategic move to manage liquidity.

This scenario reflects a broader truth in the volatile crypto market: while platforms can thrive, individual success stories are rarer. The allure of quick gains through memecoin trading is undeniable, yet the reality is that only a tiny fraction of participants secure the substantial profits they aim for. The discrepancy between platform revenue and individual trader success highlights the speculative nature of such investments and underscores the importance of understanding market dynamics beyond the surface-level statistics.

In essence, while Pump.fun continues to generate substantial income, the journey to personal profit for traders remains full of challenges, requiring market insight, strategic patience, and a lot of luck.